How to make a tax deduction for medical services. How to get a tax deduction for treatment: who can receive it, for what services, within what time frame and with what restrictions. Return Application

Every citizen of the Russian Federation who works officially and pays an income tax of 13% has the right to return part of the funds spent on treatment. Let’s take a closer look at how to properly refund tax for treatment and what documents are needed for this.

General requirements

A tax deduction amounting to 13% of the income tax paid is due to every working citizen who paid from his own funds:

- own treatment;

- treatment or rehabilitation of children under eighteen years of age;

- treatment or rehabilitation of a spouse or parents;

- independently purchased medications that were prescribed by the attending physician for all of the above categories;

- insurance premiums for voluntary health insurance policies - both your own and your family members.

Attention! A tax refund for treatment for pensioners who receive only a pension and have no other income on which personal income tax is paid at a rate of 13% is impossible. However, their children can receive compensation if it is confirmed that they paid for the treatment. Also, those citizens who work unofficially or are individual entrepreneurs, but pay taxes under a different system, are not entitled to a personal income tax refund. That is, if you do not pay personal income tax in the amount of 13%, then you will not see a tax deduction.

The tax refund for treatment is carried out on the basis of Decree No. 201 of the Government of the Russian Federation of March 19, 2001, as well as paragraph 3 of Article 219 of the Tax Code of the Russian Federation.

Now let's look at each of these points in more detail.

Payment for treatment services

To be guaranteed to receive a tax refund for the treatment of parents, children or yourself, you need to make sure that the following conditions are met:

- the treatment services provided correspond to the list contained in Decree of the Government of the Russian Federation No. 201;

- the treatment was carried out in a medical institution that has a state license to provide medical services;

- Payment for treatment and prescribed procedures was made at the expense of the taxpayer himself, and there is documentary evidence of this.

Purchasing medicines

In order for the tax refund for treatment to include the purchase of necessary medications, several conditions must also be met:

- all medications were prescribed by the attending physician and were used only to treat the taxpayer himself or his immediate family;

- the purchased drugs are included in the list of medications provided for by Resolution No. 201;

- the payment was made from the taxpayer’s personal funds and this can be documented.

Payment for VHI policy

Also, a tax refund for treatment is due in cases where the payment for a medical insurance policy (voluntary) was made at the expense of the taxpayer’s personal funds. In this case, a number of conditions must also be met:

- the insurance company that has entered into a VHI agreement with you has a license in the relevant area;

- only medical services are included in the insurance contract;

- The insurance policy is voluntary and premiums have already been paid.

Dental treatment

Another important question that concerns a considerable number of taxpayers is whether a tax refund is possible for dental treatment. Of course, yes, such a right is enshrined in paragraph 1 of Article 219 of the Tax Code of the Russian Federation. Moreover, you can get back part of your personal income tax paid not only for the treatment of your own teeth, but also for the healthy smile of your closest relatives. The only difference is in the amount: for yourself you can get up to 100 thousand rubles, but for your relatives - only 50 thousand.

The condition for receiving a personal income tax refund in this case is treatment only in a licensed clinic.

And one more important condition: you can receive a tax refund only for dental treatment, but not for aesthetic services. For example, whitening or expensive metal-ceramic implants will not pay for you, but installing a filling or gumboil treatment will do just fine.

Procedure for filing a tax deduction

So, how does an income tax refund for treatment, rehabilitation or the purchase of medicines occur:

- First of all, you need to contact the accounting department at your place of work and obtain a certificate - form 2-NDFL, which indicates the amounts of accrued and withheld tax deductions for the corresponding period.

- Fill out (independently) a tax return - form 3-NDFL - for one tax period. Please note: if your treatment process lasts for a long time (for example, treatment began in November 2013 and ended in February 2014), then you must submit two declarations - for 2013 and 2014. respectively.

- The next step is to collect the full package of necessary documents, after which you need to visit the tax authority at your place of registration and write an application for income tax refund, indicating the payment details, where the funds will then be transferred to you.

- If for some reason you cannot visit the tax office in person, send a package of documents by certified mail with an open list of attachments. Estimate the cost of each document at a symbolic 1 ruble. and the cost of sending the entire letter will not be too much. Please note that when sending documents with a valuable letter, you do not need to seal the envelope, because the post office employee is obliged to check the documents’ compliance with the list of contents, after which the envelope will be sealed.

Documentation

So, if you are applying for a tax refund for treatment, you will need the following documents:

- declaration 3-NDFL for each individual tax period;

- 2-NDFL certificate from each place of work, if you have several;

- original and certified photocopy of the passport of a citizen of the Russian Federation;

- TIN certificate (original and copy);

- an agreement with a medical institution (indicating the license) for the provision of treatment and rehabilitation services;

- certificate of payment for medical services provided in a special form approved by Order of the Ministry of Health and the Ministry of Taxes of the Russian Federation No. 289/BG-3-04/256 dated July 25, 2001;

- prescriptions from the attending physician, written out in form 107-U;

- checks and receipts confirming payment for medical services;

- checks for payment and corresponding receipts, sales receipts from pharmacy points confirming the purchase of medications prescribed in Form 107-U.

If you paid for treatment services for spouses, parents or children under the age of majority, then you additionally need to prepare documents confirming the fact and degree of relationship - a marriage certificate, a birth certificate, your own birth certificate.

Please note that all checks, contracts and receipts for the provision of services must be issued not to the person who underwent treatment, but to the one who paid for it, that is, to the taxpayer himself (relevant when paying for the treatment of relatives).

Amount of compensation

Tax refunds for expensive treatments are calculated for the previous calendar year and have some limitations.

- The amount of compensation cannot exceed 13% of the total amount spent on treatment, insurance or the purchase of medicines.

- The maximum payment amount cannot exceed 15 thousand 600 rubles, which is 13% of 120 thousand rubles. — the maximum amount established by Decree of the Government of the Russian Federation No. 201.

- The previous restriction does not apply to cases where the treatment was considered expensive - such services are reimbursed in full.

- The amount of income tax subject to refund cannot exceed the actual amount of personal income tax paid in total for the past year.

- If the amount of tax that is subject to reimbursement is greater than the total personal income tax paid for the year, then the balance cannot be carried forward to the next year.

- All documents are submitted to the tax service in the first quarter of the year following the reporting year.

Features of obtaining a deduction for expensive treatment

The next issue that is worth dwelling on in more detail is the refund of income tax for treatment if it is considered expensive. In this case, a tax deduction can be made if the following conditions are simultaneously met:

- the taxpayer received a certificate from a medical institution, which clearly states that without purchasing expensive medications (consumables), treatment was impossible;

- a certificate of payment for medical services provided to the tax service is indicated by code “2”;

- there is confirmation that the medical institution does not have the above medications (expensive), but their purchase at the expense of the patient or the person paying for the treatment is provided for in the contract;

- medications and consumables used during the treatment of a patient are included in the List of medications (services), reimbursement for which is provided for by law;

- the costs of treatment (purchase of drugs and consumables) were paid directly by the taxpayer himself, and the treatment was carried out in a medical institution licensed by the Russian Federation to provide such services.

It is worth remembering that the social tax deduction for personal income tax for expensive treatment has no restrictions. Money spent on this type of service can be returned in full.

Deadlines

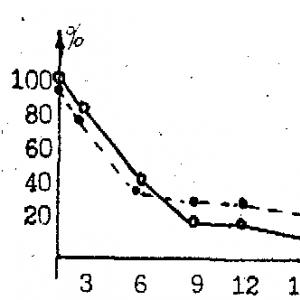

Now let's talk about how long a medical tax refund lasts. The deadlines for such compensation are strictly prescribed by law, and, it must be said, this process is quite lengthy.

The total period allocated for this procedure can be 4 months from the date of submission of the application. Of these, three whole months are allotted for conducting an on-site (desk) audit, after which a decision will be made to refund you part of the income tax paid in the previous year. During this period, you may need to visit the tax office several times to clarify any data or clarification that requires your direct presence.

If the decision is positive, then the tax service is given another whole month to actually transfer the refunded funds to your current account.

Remember, if the tax service exceeded the deadlines established by law (clause 10, article 78 of the Tax Code of the Russian Federation), then for each day of delay in returning part of the personal income tax you are entitled to compensation in the amount of the refinancing rate of the Central Bank of Russia.

This social tax deduction is an opportunity to return part of the funds spent on treatment and the purchase of medicines.

The conditions for receiving this type of deduction are the presence of the status of a resident of the Russian Federation and income taxed at a rate of 13%.

What expenses can be reimbursed?

- Tax deductions can be obtained for expenses on:

- own treatment or treatment of relatives (spouse, parents, children under 18 years of age) in medical institutions in Russia;

- purchasing medications for yourself or relatives prescribed by your doctor and purchased at your own expense;

- payment for voluntary medical insurance (under an agreement with an insurance organization) for yourself or your relatives.

Features of the deduction application

- The maximum deduction for treatment (both for yourself and for close relatives) is 120,000 rub. You can return up to 13% of expenses incurred, but no more 15,600 rubles(excluding the amount of deduction for expensive treatment);

- Deduction provided only on condition that a medical institution or insurance organization has license, for the implementation of medical (insurance) activities in Russia.

- The balance of the tax deduction is not carried forward to subsequent periods. That is, if it was not possible to receive the entire deduction in one year, it will not be possible to transfer it to the next year;

- Deduction for treatment - reusable. You can apply for it every year within the established limit (without a limit if the treatment is expensive);

- The agreement and payment documents must be drawn up by the deduction applicant. This restriction does not apply to spouses. When one spouse claims a deduction for the other, it does not matter who all the documents were issued for and who paid for the treatment;

- The deduction for treatment has a statute of limitations - no more than three years from the date of expenses. Thus, in 2017, you can return the costs of treatment paid for in 2016, 2015, 2014;

- In order to receive a deduction specifically for expensive treatment, the certificate of payment for medical services must indicate the code "02"

The amount is 120,000 rubles. is common to all social expenses (except for expensive treatment and education of children and siblings). What expenses should be included in the tax deduction? the taxpayer decides;

Note: deduction limit of 120,000 rubles. Expensive medical treatment and medications are not covered.

When paying for expensive medical services, you can get back up to 13% of them full cost(in addition to all other social deductions), but for this they must be included in a special list of expensive medical services approved by the Government of the Russian Federation.

Note: the final decision to recognize certain services as expensive is at the discretion of the Ministry of Health and Social Development. In this regard, if the service provided is not included in the list, you must contact the Ministry of Health and Social Development for clarification regarding the possibility of classifying it as expensive.

Paid medical services and medications must be included in a special list of medical services and medications approved by the Government of the Russian Federation.

Note: a deduction can also be received for a medicine that is not included in the specified list, but contains a substance specified in this list).

The deduction can be obtained only if in the year in which the treatment was paid for (medicines were purchased), there was income subject to personal income tax at a rate of 13%;

Note: It should be noted that there are no clear instructions on the prohibition of receiving a deduction if there was no income at the time of payment for treatment (purchase of medicines).

Examples of calculating tax deductions for treatment expenses

Example 1. Deduction for own treatment

Conditions for receiving a deduction

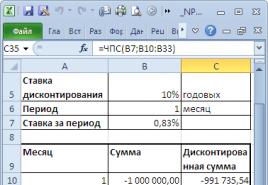

In 2016, Petrov I.A. paid for his treatment in a paid medical institution 60,000 rub.

480,000 rub.

62,400 rub.(RUB 480,000 x 13%).

Tax deduction calculation

Treatment expenses in 2016 amounted to 60,000 rubles. Therefore, the amount due for refund will be equal to: 7,800 rub.(RUB 60,000 x 13%).

Since for 2016 Petrov I.A. paid income tax in the amount of more than 7,800 rubles, and treatment expenses do not exceed the limit of 120,000 rubles, he will be able to receive a tax deduction in full - 7,800 rub.

Example 2. Deduction for own treatment costing more than 120,000 rubles.

Conditions for receiving a deduction

In 2016, Petrov I.A. paid for his treatment at a medical institution 90,000 rub., and also purchased, as prescribed by the doctor, medications necessary for treatment, in the amount of 40,000 rub.

Income received and personal income tax paid

Income for 2016 of engineer I.A. Petrov made up 480,000 rub.(RUB 40,000 (salary) x 12 months).

The amount of personal income tax (personal income tax) withheld by the employer for the year was 62,400 rub.(RUB 480,000 x 13%).

Tax deduction calculation

In general, the costs of treatment of Petrov I.A. in 2016 amounted to 130,000 rub., but since there is a deduction limit for social expenses - 120,000 rubles, therefore, the amount due for refund will be equal to: 15,600 rub.(RUB 120,000 x 13%).

Since in 2016 Petrov I.A. paid income tax in the amount of more than 15,600 rubles, he will be able to receive a tax deduction in full - 15,600 rub.

Example 3. Deduction for the treatment of a child

Conditions for receiving a deduction

In 2016, Petrov I.A. paid for the treatment of his 15-year-old daughter in a paid medical institution, 70,000 rub.

Income received and personal income tax paid

Income for 2016 of engineer I.A. Petrov made up 480,000 rub.(RUB 40,000 (salary) x 12 months).

The amount of personal income tax (personal income tax) withheld by the employer for the year was 62,400 rub.(RUB 480,000 x 13%).

Tax deduction calculation

Since the daughter's age under 18 years old, Petrov I.A. has the right to take advantage of a tax deduction for the costs of her treatment. The amount due for refund will be equal to: 9,100 rub.(RUB 70,000 x 13%).

Since for 2016 Petrov I.A. paid income tax in the amount of more than 9,100 rubles, he will be able to receive a tax deduction in full - 9,100 rub.

Example 4. Deduction for expensive treatment

Conditions for receiving a deduction

In 2016, Petrov I.A. paid for an expensive lung operation costing 500,000 rub.

Income received and personal income tax paid

Income for 2016 of engineer I.A. Petrov made up 480,000 rub.(RUB 40,000 (salary) x 12 months).

The amount of personal income tax (personal income tax) withheld by the employer for the year was 62,400 rub.(RUB 480,000 x 13%).

Tax deduction calculation

Since surgical treatment of severe forms of respiratory diseases is included in the list of expensive medical services for which a tax deduction is provided in full(without a limit of 120,000 rubles) the amount due for return will be equal to: 65,000 rub.(RUB 500,000 x 13%).

However, for 2016 Petrov I.A. paid personal income tax in the amount of less than 65,000 rubles, so he can only return - 62,400 rub.(amount of income tax paid for the year).

Example 5. Deduction for treatment along with other social deductions

Conditions for receiving a deduction

In 2016, Petrov I.A. paid for the medicines necessary for the treatment of his wife in the amount of 60,000 rub., as well as your tuition at the institute in the amount of 80,000 rub.

Income received and personal income tax paid

Income for 2016 of engineer I.A. Petrov made up 480,000 rub.(RUB 40,000 (salary) x 12 months).

The amount of personal income tax (personal income tax) withheld by the employer for the year was 62,400 rub.(RUB 480,000 x 13%).

Tax deduction calculation

Expenses of Petrov I.A. for 2016 amounted to 140,000 rub.(60,000 rubles (for medicines) + 80,000 rubles (for training)), but since the amount of social deductions for the year cannot exceed 120,000 rubles, he will only be able to return: 15,600 rub.(RUB 120,000 x 13%).

Since for 2016 Petrov I.A. paid personal income tax in the amount of more than 15,600 rubles, he will be able to receive the amount due for refund in full - 15,600 rub.

Ways to receive a tax deduction

Through the Federal Tax Service

The procedure for obtaining a tax deduction for treatment expenses through the tax service occurs in 3 stages:

To receive a tax deduction for treatment expenses, the following documents are required:

Main documents:

- Declaration in form 3-NDFL. Please note that the declaration form must be current for the year for which the deduction is claimed. That is, if a deduction is claimed for 2013, the declaration must be current for 2013.

Help 2-NDFL. It can be obtained from the accounting department at your place of work (if you worked in several places during the year, you must take a certificate from each of them).

Note: certificate 2-NDFL is not included in the list of mandatory documents required to be submitted when applying for a deduction.

Additional documents for deduction for medical services:

- Copies of payment documents, confirming the fact of payment for treatment (receipts, payment orders, etc.).

Agreement with a medical institution, which states the cost of treatment. A copy of the agreement, certified personally by the applicant, is submitted to the tax service (each page of the copy must be signed).

The contract must indicate license details for carrying out medical activities. If they are absent, you must additionally provide copy of the license.

Note: if you want to receive a deduction for expensive treatment, then the costs incurred for it must also be specified in the contract with the medical institution.

Certificate of payment for medical services issued by the medical institution that provided the service.

When undergoing treatment at a sanatorium-resort institution, it is also necessary to obtain a medical certificate. It should reflect the cost of treatment minus food, accommodation, etc.

Additional documents for deduction for the purchase of medicines:

- Recipe, prescribed by the attending physician for the purchase of medicines, drawn up in form No. 107-1/u, and containing a special stamp intended for the tax authorities.

- Copies of payment documents, confirming the fact of payment for medicines (receipts, cash receipts, payment orders, etc.).

Additional documents for deduction for health insurance:

- A copy of the agreement with the insurance organization or policy. The contract must indicate license details for carrying out insurance activities. If they are absent, it is additionally necessary provide a copy of the license.

- Copies of payment documents, confirming the fact of payment of insurance premiums (receipts, payment orders, etc.).

Additional documents for deduction for relatives:

- A copy of the child’s birth certificate (in case of deduction for children).

- Copy of marriage certificate (in case of deduction for the spouse).

- A copy of the applicant's birth certificate (in case of deduction for parents).

note When submitting copies of documents to the tax service, it is recommended to have their originals with you.

The second stage is the transfer of collected documents to the tax authority

You can transfer the collected documents in the following ways:

- Personally by contacting the territorial tax authority at your place of residence. With this method, the tax inspector will personally check all the documents and, if necessary, immediately tell you which documents are missing or which need to be corrected.

- Through a representative by notarized power of attorney (some tax services accept documents by handwritten power of attorney).

- Using the taxpayer’s personal account (LKN), located on the website of the Federal Tax Service of the Russian Federation. In order to gain access to the LKN, you must contact any tax authority to create an account and receive a login and password to enter it. To do this, you need to take your TIN and passport with you. There is no fee for connecting LKN.

By mail- a valuable letter with a description of the attachment. To do this, you need to enclose the documents in an envelope (do not seal the envelope) and make 2 copies of the postal inventory listing all enclosed documents.

This method does not require a visit to the tax office, but if mistakes were made or the package of documents was not collected in full, you will find out about it only after 2-3 months (after checking the documents).

Note: the 3-NDFL declaration and the set of documents necessary to obtain a tax deduction can be submitted to the tax service throughout the year.

The third stage is checking documents and obtaining a tax deduction

Verification of the tax return and accompanying documents is carried out in within 3 months from the date of their submission to the tax authority.

Within 10 days after the end of the audit, the tax service must send a written notification to the taxpayer with the results of the audit (grant or refusal to provide a tax deduction).

After receiving the notification, you must come to the tax authority and submit an application for a personal income tax refund indicating the bank details by which the money transfer will be made.

Funds must be transferred to within 1 month from the date of filing an application for a personal income tax refund, but not earlier than the end of the document verification (desk audit).

For what period can I get a tax deduction?

You can receive a tax deduction only for those years in which payment for treatment was directly made.

In this case, you can submit a declaration and return the money only next year, for the year in which treatment expenses were incurred. For example, if you paid for treatment in 2015, then you can return the money only in 2016.

The 3-NDFL declaration and the documents necessary to obtain a tax deduction can be submitted to the Federal Tax Service throughout the year.

How to get a social deduction through an employer

Since 2016 You can get a tax deduction for treatment from your employer. In this case, income tax at a rate of 13% will no longer be withheld from wages.

The main feature of this method is that to receive a deduction you do not need to wait until the end of the year (as is the case with the tax office); you can apply for a deduction immediately after paying for treatment.

The procedure for obtaining a deduction through an employer occurs in 3 stages:

The first stage is collecting the necessary documents

The list of documents for obtaining a deduction through an employer coincides with the documents that are required to obtain a deduction through the tax service (see above).

But there are the following differences:

- There is no need to fill out a tax return in Form 3-NDFL.

- You do not need a certificate in form 2-NDFL.

- The application for a tax deduction must be completed using a different form.

The second stage is the transfer of collected documents to the tax authority

After all the documents have been collected, they must be submitted to the tax service at your place of residence. The methods for transferring documents are the same as in the case of receiving a deduction through the tax service (see above).

After 30 days (allotted for document verification), the tax service should receive notification, confirming the right to receive a deduction from the employer.

The third stage – obtaining a tax deduction

After receiving a notification from the tax service, you must write an application for the deduction and, together with the notification, submit it to the accounting department at your place of work.

Starting from the date of notification to the accounting department, income tax will no longer be withheld from wages, as a result of which it will become 13% more than usual. This will continue until the deduction is completely exhausted or until the calendar year ends.

Note: if during the year the employer provided the employee with a deduction not full size(for example, for those months while he was filling out documents to receive a deduction), then the unused balance can be obtained at the end of the year by contacting the tax service (see above for the procedure for obtaining a deduction through the tax office).

To receive a deduction, you must collect a package of documents:

For medical services

For a minor

If you are applying for a tax deduction for a child, you will additionally need a birth certificate. child.

For an adult when applying for a refund for himself, a relative or spouse

If you plan to receive a deduction only for yourself, you need to provide a standard package of documents to the tax authority.

If so, you must also present a marriage registration certificate. A tax deduction for parents will be issued if you have your birth certificate. If, a document confirming the relationship is required.

Close relatives include parents, spouses and children under 18 years of age (including wards and adopted children)

For a child over 18 years of age by one of the parents

Parents are entitled to reimbursement of expenses for who is studying full-time and is a student, cadet, undergoing postgraduate study, residency. Each parent or one parent has the right to a deduction in double amount. To do this, one of the spouses must provide a certificate to the employer about the absence of rights to benefits.

When a spouse is on parental leave, then the second spouse loses the right to 2 deductions. If one of the spouses does not work, the situation is similar.

ATTENTION! When applying for a deduction for close relatives, it is important that the agreement with the medical institution is concluded not with the relative, but with the taxpayer himself.

What additional information can be requested to receive a 13 percent tax refund?

When refunding tax, presentation of documents confirming payment is not a mandatory condition (receipts, checks, payment orders). It will be enough to present a certificate of the cost of medical services. But it is necessary that these documents are available, since some tax authorities may require copies of payment documents to be attached to the documentation set.

When refunding tax, presentation of documents confirming payment is not a mandatory condition (receipts, checks, payment orders). It will be enough to present a certificate of the cost of medical services. But it is necessary that these documents are available, since some tax authorities may require copies of payment documents to be attached to the documentation set.

In addition, it is necessary to remember that when applying for a deduction for payment for medical drugs, copies of supporting documents are required.

Documents for tax deduction can be certified either by a notary or independently: the applicant writes “true copy” on all pages of the document, signs, decrypts and dates.

Submission deadlines

You can receive social benefits with the help of the Federal Tax Service for the last three years, during which expenses were incurred for medical services and the purchase of medications. Filing a tax return is possible throughout the year, but you must understand that a desk audit can take up to 3 months. Because, The sooner a set of documents is submitted, the sooner you can receive 13% of the costs incurred.

You will find more information about the statute of limitations and filing a return to receive a tax deduction for treatment.

How to submit papers for a declaration - step-by-step instructions

Any taxpayer who is eligible to receive a tax deduction can do so.

Personally

If you want to apply for a benefit, you need to collect a set of documents and submit them to the tax service and receive a receipt from the inspector. After the desk audit, the deduction amount will be transferred.

Through an intermediary

It is possible to obtain a deduction with the help of an employer; for this you need a set of documents (without F3 personal income tax) and submit an application for a deduction to the local branch of the Federal Tax Service. After the service reviews the application, it will issue a notification, which the employee submits to his accounting department along with the application for a deduction. From the month of filing documents, the employer must not withhold personal income tax from the employee’s salary.

ATTENTION! Receiving a deduction through an employer is possible only for the current year.

A set of documents can be transferred with the help of a representative using a power of attorney certified by a notary.

Recently, it became possible to submit documents for a tax deduction using a multifunctional center (MFC). To do this you need:

Recently, it became possible to submit documents for a tax deduction using a multifunctional center (MFC). To do this you need:

- Make an appointment at the center in advance (or take an electronic queue coupon).

- Come to your appointment with the required set of documents.

- Submit a declaration f. No.-NDFL.

- With the help of a specialist, fill out an application for a refund of the deduction for treatment (there is a sample at the MFC).

- Next, it remains to monitor the status of the application using the number that is issued with a receipt for receipt of documents by the MFC employee.

- Once ready, you will need to arrive at the Federal Tax Service office with your passport.

Online

You can submit an application for a deduction using your personal taxpayer account (LKN), which is located on the website of the Federal Tax Service of the Russian Federation. Access to your account can be obtained from any tax authority; to do this, you need to request a login and password from the Federal Tax Service. You need to have your passport and Taxpayer Identification Number with you. This service is free.

By mail

You can also send documents using a registered valuable letter with the described content. To do this, you need to put all the documents in an unsealed envelope and make an inventory in two copies. This method will be convenient because you will not need to visit the organ in person. The downside is that if mistakes were made when completing the package of documents, this will become known only after 2-3 months.

The funds are directly refunded to the taxpayer’s bank account throughout the year. To receive 13% of funds spent on medical services, a citizen must certify to the tax office that he is officially employed and regularly pays personal income tax. This can be done with documentation, plus provide proof of expenses incurred.

The funds are directly refunded to the taxpayer’s bank account throughout the year. To receive 13% of funds spent on medical services, a citizen must certify to the tax office that he is officially employed and regularly pays personal income tax. This can be done with documentation, plus provide proof of expenses incurred.

Remember that it is not at all difficult to return part of the money paid for the treatment of yourself and your loved ones. It is even possible not to appear at the tax office in person, sending documents for registration by mail or by an authorized representative. The most important thing is to work officially and have stable personal income tax deductions.

You can get back the money you paid to the government in taxes, or you can choose not to pay tax (up to a certain amount). To do this, you need to get a so-called tax deduction, that is, reduce your taxable income. A tax deduction is an amount that reduces the amount of income on which tax is levied. Often the income you receive is only 87% of what you earned. Because your employer (or other agent) pays 13 rubles out of every 100 rubles for you as tax (personal income tax, otherwise called income tax). In some cases, you can get this money back. Such cases include some medical expenses - payment for treatment and purchase of medicines. Treatment deduction is one of the types of so-called tax social deductions. Article 219 of the second part of the Tax Code is dedicated to them.

How to calculate deductions and tax for refund

The deduction amount reduces the so-called taxable base, that is, the amount on which tax was withheld from you. You will be able to receive from the state in the form of tax refunds not the amount of the deduction, but 13% of its amount, that is, what was paid in taxes. At the same time, you will not be able to receive more than you paid in taxes. For example, 13% of 100 rubles is 13 rubles. You can receive 13 rubles only if you paid 13 rubles in taxes for the year. If you paid less taxes, you can only get back the money you paid. Also, when calculating, you need to take into account the deduction limit established by law. If the limit is 120,000 rubles per year, then you can return no more than 13% of the limit per year, that is, 15,600 rubles. Only taxes paid at a rate of 13% can be refunded.

Maximum deduction for which treatment

The maximum social tax deduction for treatment is 120,000 rubles per year. The exception is a special list of expensive types of treatment for which you can receive an unlimited deduction. It is possible to determine whether the list of medical services and medications for which a deduction is included in expensive treatment can be determined by the code provided by the medical institution in which the taxpayer paid for the treatment, indicated in the “Certificate of payment for medical services for submission to the tax authorities”: code “ 1” – treatment is not expensive; code “2” – expensive treatment. There is also a maximum amount for some social tax deductions together - 120,000 rubles per year. Therefore, if you apply for several types of social deductions at the same time, for example, deductions for treatment (those types for which the amount is limited), for your own education, for pensions, then in just one year you can receive a maximum deduction of 120,000 rubles in year.

Conditions for receiving a deduction for treatment

What treatments are deductible for? The deduction can be obtained for expenses for your own treatment, for your husband or wife, parents, children (under 18 years of age). That is, for example, if your parent received treatment, and you paid for the treatment and paid the tax, you have the right to a deduction (for taxes paid by you, not by the parent). Treatment must be carried out by licensed Russian medical institutions. The deduction can be received once a year an unlimited number of times. The list of medical services and the list of medicines that are subject to a deduction of a maximum amount of 120,000 rubles, including the list of medical services (types of treatment) that are subject to a deduction without restrictions, are indicated in Russian Government Decree No. 201 of March 19, 2001. To receive a tax refund, you must provide a 3-NDFL declaration and documents confirming your right to a tax refund for treatment.

Obtaining a tax deduction for dental treatment

Not everyone knows about the possibility of reducing the cost of paid treatment by 13% by refunding income tax on the amount of money spent on paid dental treatment. These services include orthopedic dentistry, filling, etc. Orthopedic dentistry and filling are not an expensive type of treatment, therefore the maximum tax deduction amount is 120,000 rubles. Those. if a taxpayer spent 120,000 rubles on treatment, then he is entitled to a maximum refund amount of 15,600 rubles (13%). Prosthetics, as well as dental implantation, are among the most expensive services in dental treatment, and of course, the possibility of receiving compensation for them is of interest to many people. Dental prosthetics is not an expensive type of treatment, so it is subject to a limit of 15,600 rubles. But dental implantation, on the contrary, is equivalent to expensive procedures, and there are no restrictions on it.

When and for what period can I receive a tax deduction?

You can return money for treatment and medications only for those years when you directly made payments. However, you can submit a declaration and return the money only in the year following the year of payment. That is, if you incurred expenses for treatment and want to receive a tax deduction for treatment in 2018, then you can return the money only in 2019.

If you did not apply for a deduction immediately, then you can do it later, but no more than for the last three years. For example, if you receive a tax deduction for treatment in 2017, you can apply for a deduction only for 2014, 2015 and 2016.

Documents for tax deduction for treatment

To receive a tax deduction for treatment, you need to collect the following package of documents and submit it to the tax office:

- Completed tax return in form 3-NDFL (original).

- Application with details of the bank account to which the money will be transferred to you (original).

- Certificate 2-NDFL about income for the year, issued by the employer (original).

- Documents confirming payment (cash receipts, or receipts, or payment orders, or bank statements, etc.) (copies are allowed).

- In the case of payment for medical services, a certificate of payment for medical services for submission to the tax authorities, issued by a medical institution. Such a certificate is needed in addition to the document confirming payment (point above). That is, you need both that document and this one (the original).

- In case of purchasing medicines, prescriptions in form N 107-1/u (a copy is allowed).

- In case of payment for treatment for a relative, documents confirming the relationship of the taxpayer with the persons for whom payment was made (birth certificate, marriage certificate, etc.) (copy).

- An agreement with a medical institution, if one was concluded, or a document confirming treatment, for example, there must be an extract from a medical record (a copy is allowed).

- License of a medical institution to carry out medical activities, if the documents do not contain information about the details of the license. If information about the license is in an agreement or other document, then the tax authorities should not require a copy of the license. However, in order to avoid possible disputes with the tax authority, we recommend attaching this document in any case (a copy).

- To receive a deduction under a voluntary medical insurance agreement, copies of: a voluntary medical insurance agreement or a voluntary medical insurance policy are required; cash receipts or receipts for insurance premiums (contributions).

- To receive a deduction for the purchase of medicines, you need copies of: the original prescription form with the prescription of medicines in the established form with the mark “For tax authorities, taxpayer’s INN”; copies of payment documents confirming the fact of payment for the prescribed medicines.

How to fill out a tax deduction for treatment 3-NDFL with Taxation

How to get a deduction for treatment, on the Taxation website you will find everything you need to get it. Now you don't need to contact consultants. You can do everything yourself:

1 Fill out the declaration on the Tax website. With us, filling out the declaration correctly will be quick and easy.

2 Attach documents according to the list to the declaration. The list, templates and sample applications for a tax refund for treatment can be downloaded for free in the “Useful” / “Documents for deduction” section of the website.

3 To receive a tax deduction for treatment, you need to take the documents to the tax office and receive the money. All you have to do is take the prepared documents to the inspectorate and receive the money.

When submitting copies of documents confirming the right to deduction to the tax office, you must have their originals with you for verification by the tax inspector.

To proceed to completing your tax return on our website, please click the Next button below.

.

Decree of the Russian Government on deductions for treatment No. 201 of March 19, 2001, describing for which medical services and medications a deduction is provided, in PDF format.