Accounting and tax services. How to open a company providing accounting services. Who and when may need the services of an accountant?

Where can I order the services of a chief accountant? What types of accountant services are there? How to determine that a private accountant is a professional in his field?

Hello, dear readers! Professional accountant Alla Prosyukova is in touch.

Today we will talk about accounting services. I will explain to you in detail and in simple language the main aspects of the provision of accounting services by third-party companies.

In my article, I will not only talk about the accounting services of outsourcing companies, but also provide an overview of three companies with an excellent reputation and favorable conditions.

1. Who and when may need the services of an accountant?

According to the Law “On Accounting”, all business entities are required to keep accounting records, unless they are exempted from this obligation by any other legislative act.

According to Russian legislation, there are few such exempt entities: individual entrepreneurs and branches of foreign companies.

And individual entrepreneurs (IP), who by law may not keep accounting, have a need for such accounting services as preparing and submitting a tax return, and if the IP is an employer, then add to this payment calculations and salary reporting. So you can’t do without accounting here either!

In addition, the services of an accountant may be required if:

- the company does not have a full-time accountant;

- the business owner wants to optimize the company's expenses;

- accounting restoration is required;

- the owner is not satisfied with the quality of services provided by the accountant who keeps records.

From the above it follows that there are many companies that may need it.

2. What services does an accountant provide - TOP 5 main types

The range of accounting services is very wide and varied.

Let's look at the most popular types.

Type 1. Accounting support

Leadership among accounting services belongs to accounting support for the activities of the customer company.

Accounting support- these are the services of an outsourcing company or a private accountant for maintaining customer records.

Benefits received from accounting support:

- savings on labor costs;

- official contract;

- the cost of services of the executing company is an expense recognized when taxing profits;

- guarantees of compensation for damage incurred due to the fault of the performer;

- professional approach;

- high quality;

- continuity of record keeping (no vacations, sick leave, etc.).

Accounting support can be full or partial.

Example

Marina, having graduated from college with honors, was able to immediately get a job as chief accountant at Kuznets LLC.

The newly appointed chief accountant did not experience fear, since she had excellent theoretical training, and she also had some practical skills (during the holidays she worked as an assistant accountant).

However, after a couple of weeks, Marina’s optimism diminished. Yes, and there was a reason! Although the LLC is small, there are 12 employees, there are several types of activities, and wages to employees are calculated in several forms (salary, piecework and bonuses).

While Marina had practically no problems with accounting for various types of activities (and she had someone to consult with if necessary), then there was trouble with wages and deductions, especially with personalized accounting.

There was no opportunity to ask the former chief accountant. There was only one way out: to outsource the wage accounting area.

By signing an agreement with the company “Your Accountant”, Marina not only solved problems with the salary area, but also acquired a professional consultant on other accounting problems.

Type 2. Restoration of accounting and tax records

In Russia, representatives of small and medium-sized businesses love to save money. They save both where necessary and where saving is undesirable, and sometimes even strictly prohibited.

They often save on accounting. They reason like this: the turnover is small, there are few employees, I will do everything myself!

And instead of handing it over to a specialist, they start drawing up primary documents and sculpting contracts from time to time.

Of course, such “accounting” will lead to problems that can only be solved by its restoration by professionals.

Accounting restoration- this is bringing the company's accounting into full compliance with the norms of current legislation.

The main reasons for restoring accounting:

- departure of the chief accountant;

- no accounting records were kept;

- interruptions in management;

- Inaccurate data was found in the accounting.

The recovery process includes a number of procedures.

Procedures for restoring accounting and tax accounting:

- assessment of the accounting status of the customer company;

- collecting, organizing, bringing primary documents into full compliance with the standards;

- conducting reconciliations with counterparties, tax authorities and funds;

- adjustment of reporting data;

- submission of updated (clarified) reporting to regulatory authorities;

- development of recommendations for further accounting for the customer.

There are indeed many professionals in the accounting services market, but there are also many self-taught accountants who have completed two-week courses. Of course, such specialists cannot provide professional services.

We have analyzed current information on the accounting services market and selected for you the most worthy representatives of this profile. Meet us!

1) My business

The company “Moyo Delo” has existed in the accounting services market for more than 7 years. The company employs about 400 professional employees: accountants, personnel officers, lawyers, tax consultants, etc.

“My Business” is the first Russian service that offers its clients online accounting services in a “one-window” mode.

The online service operates in 2 versions: for professional accountants and for entrepreneurs who want to do their own accounting.

Internet accounting has its own reference and legal system containing up-to-date solutions on all issues of accounting, tax and personnel records.

The company provides its clients with the following opportunities:

- individual expert consultations;

- generation and submission of all types of reporting;

- accounting;

- salary calculation;

- reconciliation with the tax office;

- tax calendar;

- integration with banks;

- You can evaluate the merits of the service for free;

- “smart assistant” services.

“My Business” pays great attention to pricing issues.

Tariffs for online accounting services “My Business”

№ Rate Cost 1 month in rubles

Type of ownership 1 Tax reporting 366 IP 2 USN + UTII (without employees) 833 IP/LLC 3 STS + UTII (up to 5 employees) 1299 IP/LLC 4 USN+UTII (Maximum) 1599 IP/LLC 5 USN + OSNO (Extended) 2083 OOO Find out in more detail about all the possibilities directly on the online accounting website "".

2) Olsa

Olsa is a Moscow consulting company providing accounting services for small and medium-sized businesses. The company guarantees exclusively professional services and affordable prices. A preliminary calculation made on the company’s website will allow customers to plan their expenses.

Company advantages:

- high quality of services;

- specialists with extensive practical experience;

- clear and transparent contract;

- liability insured by Rosgosstrakh;

- participation in the ratings of the RA “Expert”.

By using accounting services from Olsa, you will get a real picture of your business.

The company has been providing accounting support to companies in various fields of activity for more than 12 years: from trade to construction and production. “DebitCredit” is ready to take over the accounting of small companies - with medium turnover, the company trains the customer’s full-time accountants to work remotely in its service.

For large enterprises, DebitCredit selects and tests an accountant-operator who will take on all the necessary functions while working in the customer’s office.

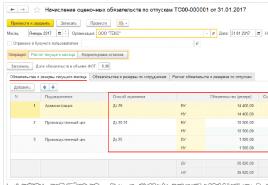

The DebitCredit service includes:

- record keeping (collection and verification of primary data, accounting in 1C);

- calculation of taxes, fees and salaries;

- tax consultations;

- all types of reporting.

For the peace of mind of its clients, DebitCredit has insured its liability with the Allianz insurance company.

5. How to find a good accountant - 4 signs that you are working with a professional

It will be easier to choose a specialist in the accounting services market if you know the hallmarks of a good accountant.

My selection of 4 signs will allow you to accurately identify a professional.

Sign 1. A good accountant always finds a common language with the tax authorities

A good accountant not only knows accounting regulations perfectly, can accurately prepare accounting entries and reports (declarations, etc.), but also has excellent communication skills.

These skills allow you to successfully negotiate, establish contacts and find a common language with any interlocutor. This ability is especially important for an accountant when interacting with regulatory authorities.

How to open a company providing accounting services? First develop a business plan, calculate the amount of initial capital, determine all the pros and cons. Find out the demand and prospects for this type of activity.

Business demand

Accounting services is a promising and in-demand business. There are a huge number of people for whom accounting and tax reporting, and simply any documents, are a dark forest and they do not want to climb into these jungles at all.

A person may be an excellent professional in his field, but registering as an entrepreneur or preparing a simple report to the tax office seems like an impossible task.

I have entrepreneurial friends who cannot (do not want) prepare zero declarations themselves. They turn to companies that provide accounting services and pay 3,000 rubles for 1 zero report. It’s easier, more convenient and calmer for them.

Undoubtedly, firms providing accounting services will be in demand. Our main clients are individual entrepreneurs and small LLCs.

Firms (not all) in which business is developing normally prefer to employ an accountant on a permanent basis. And this makes sense: in addition to accounting and tax accounting, you can assign everything to your accountant - both personnel records and a bunch of management reports.

But this won’t work with accounting outsourcing - the company will only do what is agreed upon in the contract. Did the client want an additional report? Pay for an additional service.

The demand for accounting services is growing following the number of annual reports. The market in this area is far from saturated, especially in medium and small Russian cities.

In recent years, enterprises have been actively outsourcing accounting. This is driven by endless changes in legislation, an increase in the number of reports to the Federal Tax Service, the Pension Fund of the Russian Federation, and the transition to electronic document management. The services of specialists keeping records at home have become less in demand. Many of them would like to open their own accounting services business, but do not know how or where to start.

In most cases, for an experienced accountant who is accustomed to communicating with government agencies, including the Federal Tax Service, it is not difficult to register a company and choose a tax regime. One way or another, they have encountered this at work and know where to get advice. Another thing is the organization of the company's work. Many people have questions here:

- How much accounting services are in demand, and where is this niche freer?

- how to develop a client base, where to look for potential customers;

- how to effectively organize the work of a company so that it generates income;

Brief overview: demand for services by region

Accounting outsourcing developed like an avalanche until 2013 (Fig. 1). During the recession, the number of organizations starting this business for the first time decreased. However, according to the Expert RA agency, the income of the 80 largest market participants in 2015 increased by 8%. In total, during the period from 2001 to May 2015, about 20% of newly opened companies ceased operations, and this indicates the stable operation of the vast majority of them.

Demand has decreased mainly for the preparation of financial statements according to IFRS standards, as many foreign organizations have left Russia. The main group of services - accounting and tax accounting - are still in demand (Fig. 2). According to experts, the demand for them will increase.

However, the number of open accounting firms in the country has increased significantly in recent years. In big cities there is significant competition, but in the periphery this niche is not filled everywhere. Small town entrepreneurs consider the lack of qualified services to be one of their main problems. Table 1 shows the number of companies in different regions operating in the field of accounting. Using these data, you can indirectly assess how free a niche is in a particular region.

| City, region | Total number of operating enterprises, organizations | Number of firms providing accounting services | Number of enterprises per one outsourcing company | Population |

|---|---|---|---|---|

| Moscow region | ||||

| Saint Petersburg | ||||

| Leningradskaya | ||||

| Altai region | ||||

| Arkhangelskaya | ||||

| Amur region | ||||

| Astrakhan | ||||

| Bryansk | ||||

| Belgorodskaya | ||||

| Vologda | ||||

| Volgogradskaya | ||||

| Vladimirskaya | ||||

| Voronezh | ||||

| Ivanovskaya | ||||

| Irkutsk | ||||

| Kaluzhskaya | ||||

| Kaliningradskaya | ||||

| Kemerovo | ||||

| Kostromskaya | ||||

| Kirovskaya | ||||

| Kurganskaya | ||||

| Lipetskaya | ||||

| Magadan | ||||

| Murmansk | ||||

| Nizhny Novgorod | ||||

| Novosibirsk | ||||

| Novgorodskaya | ||||

| Orenburgskaya | ||||

| Orlovskaya | ||||

| Penza | ||||

| Pskovskaya | ||||

| Rostovskaya | ||||

| Ryazan | ||||

| Samara | ||||

| Saratovskaya | ||||

| Sakhalinskaya | ||||

| Sverdlovskaya | ||||

| Smolenskaya | ||||

| Tambovskaya | ||||

| Tverskaya | ||||

| Tula | ||||

| Tyumen | ||||

| Ulyanovskaya | ||||

| Chelyabinsk | ||||

| Yaroslavskaya |

An entrepreneur who is thinking about how to open an accounting firm should understand that you shouldn’t count on high incomes right away. One of the Kontur.accounting forums published the result of a survey of participants, from which it can be seen that about 30% of those who voted earn from 70 to 250 thousand rubles per month (Fig. 3). New companies often start by servicing individual entrepreneurs and small businesses, but as their potential and reputation grow, large customers appear.

Organization of work of an outsourcing company

Registration of an enterprise, as a rule, does not cause problems for a novice accountant entrepreneur who has experience in dealing with the Federal Tax Service. It can be created either in the form of an individual entrepreneur or an LLC. The type of activity from July 11, 2016 is selected according to the new reference book OK 029-2014 (NACE Rev. 2): 69.20 - activities for the provision of accounting services, auditing, tax consulting, including maintaining, setting up, restoring accounting, submitting reports. Typically, a simplified tax regime is chosen. Entry to this market is still free. To open an accounting firm, you do not need to obtain a license and join an SRO, as for auditors.

Much more questions arise in terms of organization, because within a company it is very different from keeping records at home and the work of a chief accountant. Often a company begins with the fact that a high-level specialist cannot cope with the volume of orders and begins to look for assistants. He either organizes a new enterprise or buys out an existing one. Some clientele and at least a small cash flow are usually already available at the start. But very soon he faces two tasks:

- searching for clients - employees need to be paid regularly;

- building effective work - this determines the cost of services.

Several ways: where and how to look for customers

1. The search can be carried out using the open database of the Federal Tax Service among organizations and entrepreneurs who have submitted an application for registration (https://service.nalog.ru/uwsfind.do).

During the first 3 - 4 months of work, the issue with the accountant is often not yet resolved.

It is for this reason that many outsourcing firms engage in business registration. In most cases, if the service was provided with high quality, then the client orders accounting services from a trusted company.

As a result of the search, a list appears containing the OGRN.

Next, using the service https://egrul.nalog.ru/ you can get an extract indicating the size of the authorized capital, the legal address of the director, and telephone number.

2. Creation of a website describing services.

According to marketing research, individual entrepreneurs and small businesses are more likely to search for an accounting firm on the Internet. This is their usual way of obtaining information. Despite the fact that many automated accounting services are now offered, many are more accustomed to working with people. After all, not everyone is well versed in IT technologies; some do not want to spend time mastering programs.

They select the first 3-5 companies, then call them, compare prices, and evaluate the quality of communication. If the results of the first visit are satisfactory, they sign a contract for services; if not, they move on. Face-to-face negotiations are very important, after which the final decision is made. Therefore, for the site you need to carefully select key queries for which a potential customer searches. Information that matters when choosing:

- price list for services - it is better when their cost is average between the salary of a “coming” accountant and a good full-time specialist;

- location of the company - visits usually begin with companies located in their own or neighboring area;

- availability of contact information - a valid telephone number must be indicated, verification begins with a call;

- sample contract with commentary - this allows you to draw conclusions about the quality of work and certain guarantees from the company.

The design style of the site and the reviews provided on it practically do not matter.

Articles in specialized publications and popular local newspapers have a good effect. And it’s better if this is not naked advertising, but publications on current issues of accounting and taxes. They are used to assess the level of competence of a specialist and inspire confidence. The same goal is pursued by giving reports at various presentations, meetings, seminars - business cards are left there, and necessary contacts are made.

According to surveys of marketers, medium-sized enterprises, when switching to accounting outsourcing, are more likely to rely on recommendations and reviews. Therefore, it is useful to distribute advertising brochures and business cards through clients, familiar members of the local business community. Not only commercial enterprises are interested in outsourcing. State and municipal institutions are increasingly placing such orders on the public procurement website - this search method should not be ignored.

Typical operation scheme

The price of accounting services depends on the salary of working specialists; it is almost impossible to reduce it. At the same time, a common mistake of beginning entrepreneurs is organizing work according to the principle: one accountant/one client (or several). This often results in:

- the customer “entices” the specialist working with him;

- The accountant quits and takes his clients with him.

In addition, the employee's workload has physical limits. It is considered optimal to distribute functions between specialists so that direct communication with the customer remains only with the manager or responsible specialist (Fig. 4). Group organization of work does not require equally high qualifications of all specialists, and this makes it possible to save on wages.

It is very important to develop a flexible price list that provides differentiated tariffs for different customers, for example:

- “zero” - for newly created organizations with a zero balance;

- basic - for companies with a relatively small volume of documents;

- negotiable - for those who order a full range of services.

The client base should be regularly replenished, since entrepreneurs who have found their feet often prefer to hire “their” accountant. For stable operation, it should grow by 20 - 25% per year. For example, if a company serves 20 clients, it is advisable to conclude 4 - 5 new contracts annually.

Outsourcing companies primarily compete on prices, but dumping has limitations. The strategies of successful companies have some kind of “zest”. This may be a narrow specialization: credit servicing, work with individual entrepreneurs, or, conversely, a wide range of services, including legal ones: registration, liquidation of organizations.

You can open a company providing accounting services and start a franchise business; there are such offers on the market (Billprof and others). The biggest success: entering the “blue ocean”, that is, a new untapped niche. One of these areas: aggregators in various market sectors, working with a large number of individual entrepreneurs and accumulating a significant volume of documents: online taxi services, insurance companies, Internet advertising platforms. Below is an example of a non-standard approach: an accounting service business was launched by a programmer and a bank employee.

Knopka LLC, Yekaterinburg, initial investment 1.5 million rubles.

The company was founded in 2013 by former employees of Bank24.ru and SKB Contour, headed by Eduard Panteleev. They created a mobile office for entrepreneurs, which takes care of all administrative, accounting and legal issues, working online. By mid-2015, almost 600 entrepreneurs had joined it, and the company already had 130 employees. The cost of the minimum package of services is 24 thousand per month.

To summarize, we note: the need for accounting services will always be. At the same time, during periods of crisis there is a tendency: large companies lose customers, and small ones gain. The focus on saving forces customers to look for cheaper, “clean” services, without frills.

How to collect alimony? From what income and in what amount?

According to Article 80 of the RF IC, parents are obliged to support their minor children. But not all parents fulfill this responsibility. And then alimony is collected from the parent by force. The procedure for withholding on writs of execution is established by Federal Law dated October 2, 2007 No. 229-FZ “On Enforcement Proceedings”. Watch the video prepared by the Managing Partner of the company "RosCo - Consulting and Audit" Alena Talash and find out.... 1. From what income of the employee is alimony collected? 2. What payments cannot be used to collect alimony? 3. In what form can alimony be established? 4. About the amount of alimony. 5. The order of deductions of alimony. All the most interesting things about taxes, law and accounting from the leading consulting company in Russia "RosCo". Stay up to date with the latest news, watch and read us where it is convenient for you: YouTube channel - https://www.youtube.com/c/RosCoConsultingaudit/ Facebook - https://www.facebook.com/roscoaudit/ VKontakte - https://vk.com/roscoaudit Twitter - https://twitter.com/RosCo_audit Instagram - https://www.instagram.com/rosco. how to collect alimony

Tax benefits for small businesses. How to avoid paying taxes?

What tax benefits can small businesses apply in Russia? What preferences can businessmen operating in priority sectors of the economy receive? 1. WHAT ARE THE BENEFITS FOR PAYERS ON THE USN? 2. FEATURES OF TAX HOLIDAYS. 3. BENEFITS FOR PAYERS WORKING ON A PATENT. 4. WHAT ARE THE PROPERTY TAX BENEFITS? See the material about this prepared by the Managing Partner of the company "RosCo - Consulting and Audit" Alena Talash. Read: https://site/press/nalogovye_lgoty_dlya_subektov_malogo_biznesa/ All the most interesting things about taxes, law and accounting from the leading consulting company in Russia "RosCo". Stay up to date with the latest news, watch and read us where it is convenient for you: YouTube channel - https://www.youtube.com/c/RosCoConsultingaudit/ Facebook - https://www.facebook.com/roscoaudit/ VKontakte - https://vk.com/roscoaudit Twitter - https://twitter.com/RosCo_audit Instagram - https://www.instagram.com/rosco. benefits for small businesses taxes individual entrepreneur 2019 how not to pay taxes how not to pay taxes

Chief Accountant. What is the chief accountant responsible for? In simple words

What should the chief accountant know? The issue of responsibility is perhaps the most pressing issue for every employee whose responsibilities include making decisions on important areas of the employer’s activities. The most responsible job is, of course, performed by the chief accountant. His work is related to making financial decisions, preparing accounting and tax documents, and submitting these documents to authorized bodies. In this material we will consider what kind of responsibility can be applied to the chief accountant, and what he risks. More details about: - administrative; - disciplinary; - material; - criminal and subsidiary liability. And also about fines, penalties and criminal sentences against the chief accountant, see the material prepared by the lawyer of the RosCo - Consulting and Audit company, Kirill Bogoyavlensky. Read: https://site/press/za_chto_otvechaet_glavnyy_bukhgalter/ All the most interesting things about taxes, law and accounting from the leading consulting company in Russia "RosCo". Stay up to date with the latest news, watch and read us where it is convenient for you: YouTube channel - https://www.youtube.com/c/RosCoConsultingaudit/ Facebook - https://www.facebook.com/roscoaudit/ VKontakte - https://vk.com/roscoaudit Twitter - https://twitter.com/RosCo_audit Instagram - https://www.instagram.com/rosco.

According to Federal Law 402 of December 6, 2011 “On Accounting”, all economic entities, namely LLCs, individual entrepreneurs and foreign representative offices are required to maintain accounting records. The BUKHprofi company provides accounting services to organizations in Moscow and the Moscow region, LLCs and individual entrepreneurs using any taxation system (USN-6%, USN-15% or OSNO) on a turnkey basis and at reasonable prices.

Of course, individual entrepreneurs and foreign representative offices and branches may not keep accounting records in accordance with the legislation of the Russian Federation on taxes and fees, but they are required to keep records of income or income and expenses, and representative offices are required to maintain records of income and expenses in accordance with the legislation of their country, and they also need to generate and submit tax reports.

Provision of accounting services

Small businesses are allowed to conduct simplified accounting. Simplified accounting is the replacement of an extended chart of accounts with a narrower one, specific to your business.

However, no one canceled the submission of the balance sheet, profit and loss statement, explanatory note, as well as the maintenance of registers, primary documentation, etc.

The service of maintaining the company's accounting, preparing and submitting reports, storing accounting documents is assigned to the chief accountant on the company's staff, or to the head of the organization, or it is necessary to conclude an agreement for the provision of accounting services with a company providing such services.

But it should be remembered that the person completing it bears full responsibility for the preparation of reporting, for reporting registers, for drawing up accounting policies, as well as for accounting and financial reporting.

Outsourcing of accounting services

Due to the complexity of accounting, as well as the unwillingness to hire chief accountants for official work, much less take full responsibility for accounting, small business managers transfer these functions to companies that provide services remotely, i.e. accounting outsourcing.

The head of the company enters into an outsourcing agreement with such a company, and they, in turn, take on the function of full maintenance of accounting, tax and personnel records.

Cost of providing accounting services in Moscow

| Service | What is included in the service | Cost per month (rub.) |

Simplified taxation system STS-6% (Income) | Calculation of quarterly advance tax, preparation of payment orders for taxes and customer requests, preparation of financial statements, calculation of wages, taxes, submission of reports to the Social Insurance Fund, Pension Fund and the Federal Tax Service. Personnel records (drawing up orders, contracts, maintaining work books, staffing, etc.) | 10 000 |

Simplified taxation system simplified taxation system-15% (Income minus expenses) | Calculation of quarterly advance tax, preparation of payment orders for taxes and customer requests, preparation of KUDIR, accounting of expenses, preparation of financial statements, calculation of wages, taxes, submission of reports to the Social Insurance Fund, Pension Fund and the Federal Tax Service. Personnel accounting services (drawing up orders, contracts, maintaining work books, staffing, etc.) | 10 000 - 12 000 |

LLC on the general taxation system (OSNO with VAT) | Quarterly preparation and submission of reports to the Federal Tax Service (electronic submission of VAT, Profit, Property, Accounting Balance), maintaining a purchase book, a sales book, generating payment orders for taxes and customer requests, calculating wages, taxes, submitting reports to extra-budgetary funds and the Federal Tax Service. Personnel records (drawing up orders, contracts, maintaining work books, staffing, etc.) | 12 000 - 14 000 |

You can find out more on our website.